Associated Companies: The New Rules

Starting from April 1, 2023, the standard rate of corporation tax will increase to 25% where profits are over £250,000. However, companies with small profits (<£50,000) will continue to pay only 19%. There is also an “intermediate effective rate” if the profits fall between these limits i.e. a sliding scale between 19% and 25%.

Associated companies: What are they?

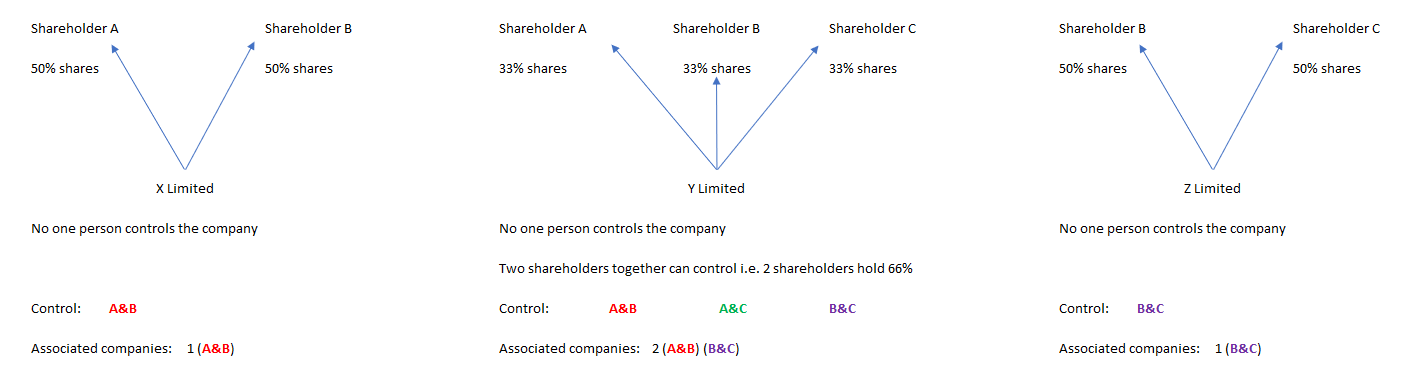

In broad terms, a company is considered associated with another if one has control over the other or if both are under the control of the same person or persons. This includes non-UK resident companies but excludes dormant and certain passive entities.

What is the impact on my company?

In cases where a company has associated companies, the thresholds for applying the standard rate of corporation tax will be reduced, distributing the potential benefit among them.

Example:

Broadland Limited is controlled by a sole shareholder - Daryl.

Daryl is also the sole shareholder of Kingfisher Limited.

Because Daryl holds 100% of the shareholding and thus is in control of both entities, the companies are deemed associated.

Therefore, the corporation tax thresholds are split between the two companies, as per the table below.

Essentially, where there are a total of 2 associated companies, the thresholds are halved. If there were 3 associated companies, the thresholds would be divided by 3, and so on.

Are my companies associated?

A good place to start is to consider whether an individual or a group of individuals have overall control of multiple companies. However, unfortunately, the rules for associated companies are quite complex. Companies that are within the same group may still be associated. Moreover, the combination of this broad definition with the exclusions for dormant and passive entities results in the number of associated companies not necessarily equating to the number of companies in a given group.

In specific cases, additional complexity arises when determining whether there is "substantial commercial interdependence" between two companies, requiring an assessment rather than a simple mechanical test.

Below are some typical examples of groups in our client portfolio that would need to consider whether they are associated:

Example 1: Where there are associated companies

Example 2: Where there are no associated companies

N.B.

A shareholder or group of shareholders need to have >51% of the shares to have overall control

Other implications

HMRC released new guidance in December 2022 to explain the implementation of these rules. This guidance is relevant not only to larger businesses that do not expect to qualify for the lower rate but also to determine when a company needs to pay corporation tax by instalments as a "large" or "very large" company for accounting periods starting on or after April 1, 2023. This new approach is more intricate than the current rule of "related 51 percent companies" and may result in earlier tax payment deadlines in certain cases, especially for groups that are already near the relevant thresholds.

As you can see, this area is quite complex so please do contact us if you would like any advice.