Mini Budget - Autumn 2022

Chancellor Kwasi Kwarteng presented his first Budget on 23 September 2022. In his speech, he announced an array of tax-cutting measures across the board.

Although there have been many changes, below we have highlighted those that we believe are most relevant to our clients: Income tax reductions to the top and basic rate earners, reversal of the 1.25% national insurance increase, cuts to stamp duty and reversal of corporation tax hike.

Income Tax Cuts

Both basic rate taxpayers and our top earners will be reaping the rewards of the latest income tax cuts.

The basic rate of tax will fall from 20% to 19% from April 2023. People with income between £12,570 (the personal allowance) and £50,270 will now pay 1p less in income tax for every £1 earned.

A more surprising announcement was that the 45% additional tax rate will be scrapped from April 2023. What this means is that people earning over £150,000 will no longer pay an additional 5% after they reach this level of income. instead, they will remain being taxed at 40% on income over and above £50,270.

National Insurance 1.25% hike scrapped

Back in September 2021, Boris Johnson announced the new “Health and Social Care Levy”. This increased national insurance and dividend rates by 1.25%.

From 6 November, the national insurance rates will return to their pre-April 2022 rates.

It is unclear at this time as to whether the 1.25% income increase on dividends has been reversed. We will update you in due course.

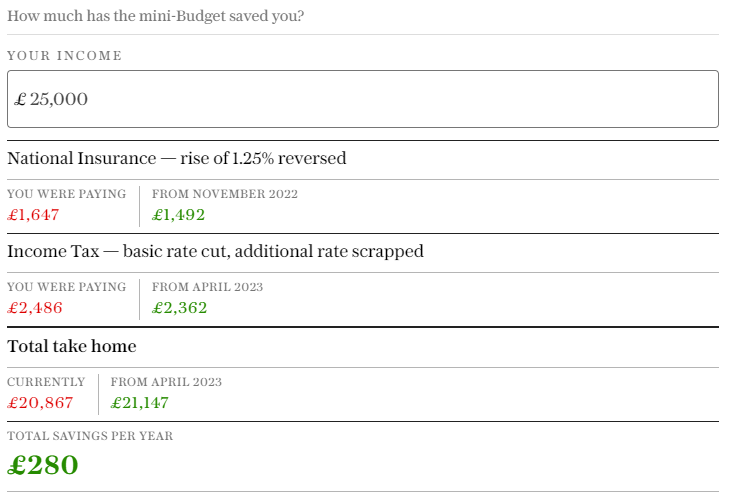

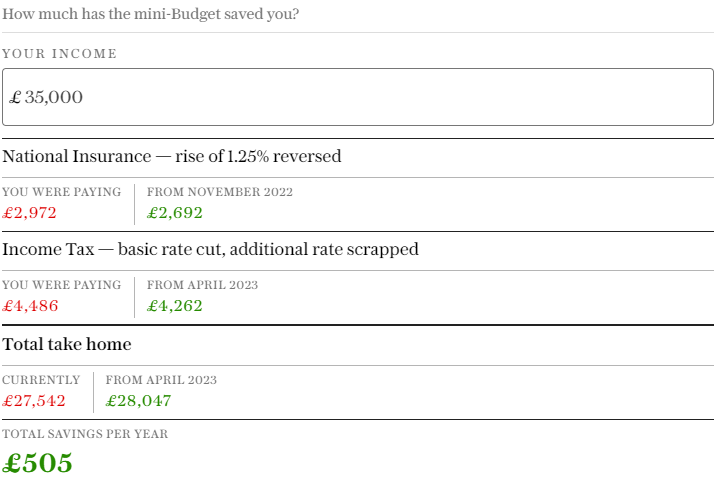

How will the changes impact me?

The tax cuts will be welcome news to most people, given the cost of living crisis we are currently in. However, how do these changes actually impact you? Below are a couple of examples to give you an idea of the kind of annual saving you are likely to make.

Corporation Tax hike scrapped

Corporation tax was set to rise on a sliding scale of up to 25% for companies that made a profit of over £50,000. However, this increase has now been scrapped and all companies will remain being taxed at 19%.

Stamp Duty cut

First-time buyers will now pay no stamp duty up to £425,000 (up from £300,000), provided that the property costs less than £625,000 (previously £500,000)

Furthermore, from today, there will be no stamp duty on property purchases on the first £250,000 (doubled from £125,000). The Treasury says this means 200,000 more people every year will be able to buy a home without paying any Stamp Duty at all.